Federal Tax Reporting

Advertisement

Depreciation 4562

Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data

Advertisement

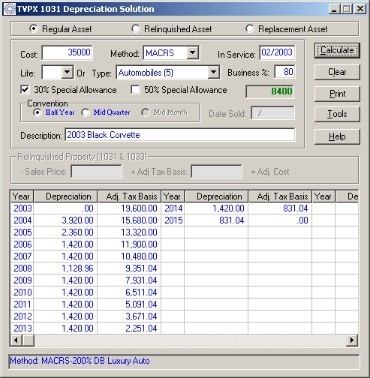

TVPX 1031 Depreciation Solution v.5.0.0001

TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format.

Income Tax Calculator v.1.5

This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2012. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total taxable income.

AcQuest Tax Penalty & Interest Evaluator v.2.00

AcQuest Programming Solutions is pleased to publish AcQuest Tax Penalty & Interest Evaluator. Designed to run on Windows 95, 98, Me, & XP systems, the program will calculate and verify federal tax penalties and interest for individuals, corporations,

AcQuest 941 Solution v.2 1

AcQuest 941 Solution is designed to run on Windows 95, 98, Me, & XP. It will prepare both pages of federal Form 941, Employer's Quarterly Federal Tax Return, with the unregistered version limitation that data can be printed but not saved.

Online Tax Pros

Take the pain out of tax time with quick and easy online tax preparation and direct e-filing to the IRS with Online Tax Pros. Online Tax Pros lets you prepare your federal tax return for free. We are also an Authorized IRS e-file Provider. Therefore, you

Minisoft AssetAge v.5 3

Assetage organizes fixed assets accounting in comprehensive formats, performs complex depreciation calculations quickly and easily, and offers powerful reports for financial and tax reporting of fixed assets.

MTW F/A Manager v.2.0.1

MTW F/A Manger is a complete fixed asset system which includes 5 depreciation books , management reporting, and asset tracking. Current tax rules for depreciation are built in,

TVPX 1031Depreciation Solution v.5.5

TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation.

TaxCut EZ v.2004

This software supports federal tax form 1040EZ. It includes a fast, customized tax interview with questions relevant to your specific tax situation, and a refund/owe meter so you can monitor your refund or amount due as you go.